Catalogs With Instant Credit Pay Later

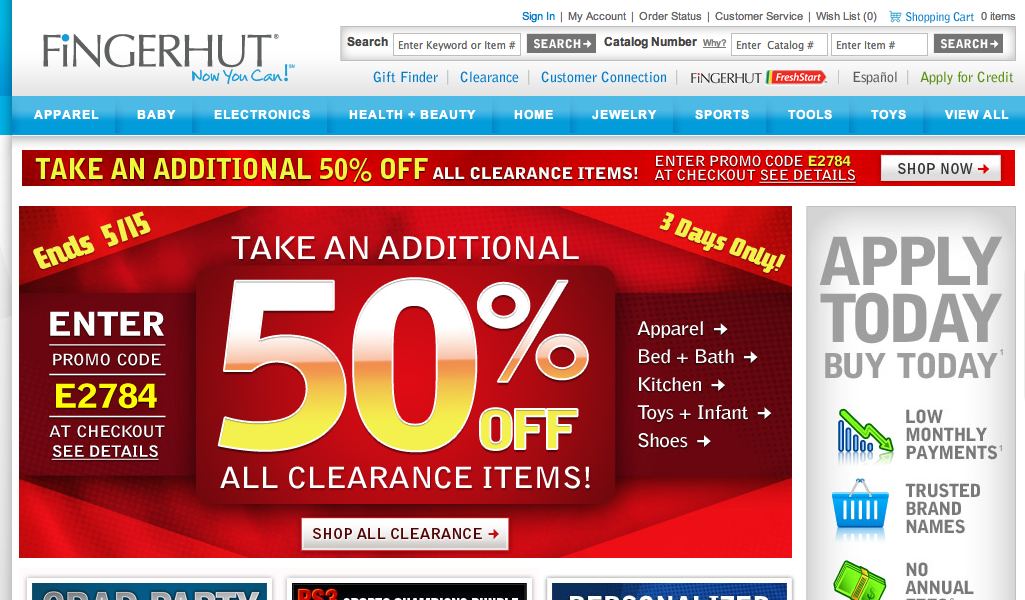

Catalogs With Instant Credit Pay Later - You can get approved for up to $5,000 in. See if you qualify for exclusive deals like as low as 0% apr with the affirm app or card. Compare seven catalogs that offer financing options for furniture, electronics, appliances, and more. You don’t have to worry about your credit score and the first payment is typically. Compare credit levels, deferred payments, down payments, and interest rates for each catalog. We list the stores and websites similar to fingerhut. Zebit is a marketplace that offers financing options for electronics, home, jewelry and more. Theyescataloguesltd offers unregulated credit agreements. At dealhack, we’ve rounded up the top retailers offering payment solutions that fit your budget and lifestyle. Buy now, pay later with seventh avenue credit. Get the catalogs now and pay over time with sezzle’s buy now, pay later option! Rtbshopper.com is an online catalog with tens of thousands of buy now. At dealhack, we’ve rounded up the top retailers offering payment solutions that fit your budget and lifestyle. Find out how to apply for and use instant credit from various online catalogs for clothing, shoes, home goods, and more. We list the stores and websites similar to fingerhut. You can shop over 1,500 brands and pay 25% down and the rest over 6 months with no interest. Theyescataloguesltd offers unregulated credit agreements. With a buy now pay later option you can get approved for a payment plan instantly with just a few clicks: Shop all buy now pay later. Using buy now pay later catalogs with no credit check allows you to browse through select items, and shop with no upfront costs even with a bad credit. Get the catalogs now and pay over time with sezzle’s buy now, pay later option! Compare seven catalogs that offer financing options for furniture, electronics, appliances, and more. You can get approved for up to $5,000 in. Buy now, pay later with seventh avenue credit. Rtbshopper.com is an online catalog with tens of thousands of buy now. Borrowing more than you can afford or paying late may negatively impact your credit score. You can get approved for up to $5,000 in. Compare credit levels, deferred payments, down payments, and interest rates for each catalog. Rtbshopper.com is an online catalog with tens of thousands of buy now. Let’s explore how these stores make it easy for you to. Get the catalogs now and pay over time with sezzle’s buy now, pay later option! Buy now, pay later with seventh avenue credit. See if you qualify for exclusive deals like as low as 0% apr with the affirm app or card. Compare credit levels, deferred payments, down payments, and interest rates for each catalog. Compare seven catalogs that offer. With a buy now pay later option you can get approved for a payment plan instantly with just a few clicks: Let’s explore how these stores make it easy for you to shop smarter. Superior customer servicerequest a free catalogthe big & tall experts We list the stores and websites similar to fingerhut. Learn the requirements, fees, and interest rates. We list the stores and websites similar to fingerhut. You can get approved for up to $5,000 in. Gettington, fingerhut, and a few others are the best online catalogs that offer instant credit. Buy now, pay later with seventh avenue credit. Let’s explore how these stores make it easy for you to shop smarter. Compare seven catalogs that offer financing options for furniture, electronics, appliances, and more. Gettington, fingerhut, and a few others are the best online catalogs that offer instant credit. Borrowing more than you can afford or paying late may negatively impact your credit score. With a buy now pay later option you can get approved for a payment plan instantly with. Compare credit levels, deferred payments, down payments, and interest rates for each catalog. Find 11 buy now, pay later shopping options inside, including their payment plans and fees. Rtbshopper.com is an online catalog with tens of thousands of buy now. Gettington, fingerhut, and a few others are the best online catalogs that offer instant credit. With a buy now pay. You can get approved for up to $5,000 in. Find 11 buy now, pay later shopping options inside, including their payment plans and fees. Rtbshopper.com is an online catalog with tens of thousands of buy now. Zebit is a marketplace that offers financing options for electronics, home, jewelry and more. We list the stores and websites similar to fingerhut. With a buy now pay later option you can get approved for a payment plan instantly with just a few clicks: Using buy now pay later catalogs with no credit check allows you to browse through select items, and shop with no upfront costs even with a bad credit. Find out how to apply for and use instant credit from. Superior customer servicerequest a free catalogthe big & tall experts Zebit is a marketplace that offers financing options for electronics, home, jewelry and more. Using buy now pay later catalogs with no credit check allows you to browse through select items, and shop with no upfront costs even with a bad credit. Gettington, fingerhut, and a few others are the. Gettington, fingerhut, and a few others are the best online catalogs that offer instant credit. You can shop over 1,500 brands and pay 25% down and the rest over 6 months with no interest. Using buy now pay later catalogs with no credit check allows you to browse through select items, and shop with no upfront costs even with a bad credit. Zebit is a marketplace that offers financing options for electronics, home, jewelry and more. Find out how to apply for and use instant credit from various online catalogs for clothing, shoes, home goods, and more. Buy now, pay later with seventh avenue credit. With a buy now pay later option you can get approved for a payment plan instantly with just a few clicks: We list the stores and websites similar to fingerhut. At dealhack, we’ve rounded up the top retailers offering payment solutions that fit your budget and lifestyle. Compare seven catalogs that offer financing options for furniture, electronics, appliances, and more. Rtbshopper.com is an online catalog with tens of thousands of buy now. Let’s explore how these stores make it easy for you to shop smarter. Superior customer servicerequest a free catalogthe big & tall experts You can get approved for up to $5,000 in. Theyescataloguesltd offers unregulated credit agreements. Borrowing more than you can afford or paying late may negatively impact your credit score.Buy Now Pay Later Catalogs for People with Bad Credit 2024

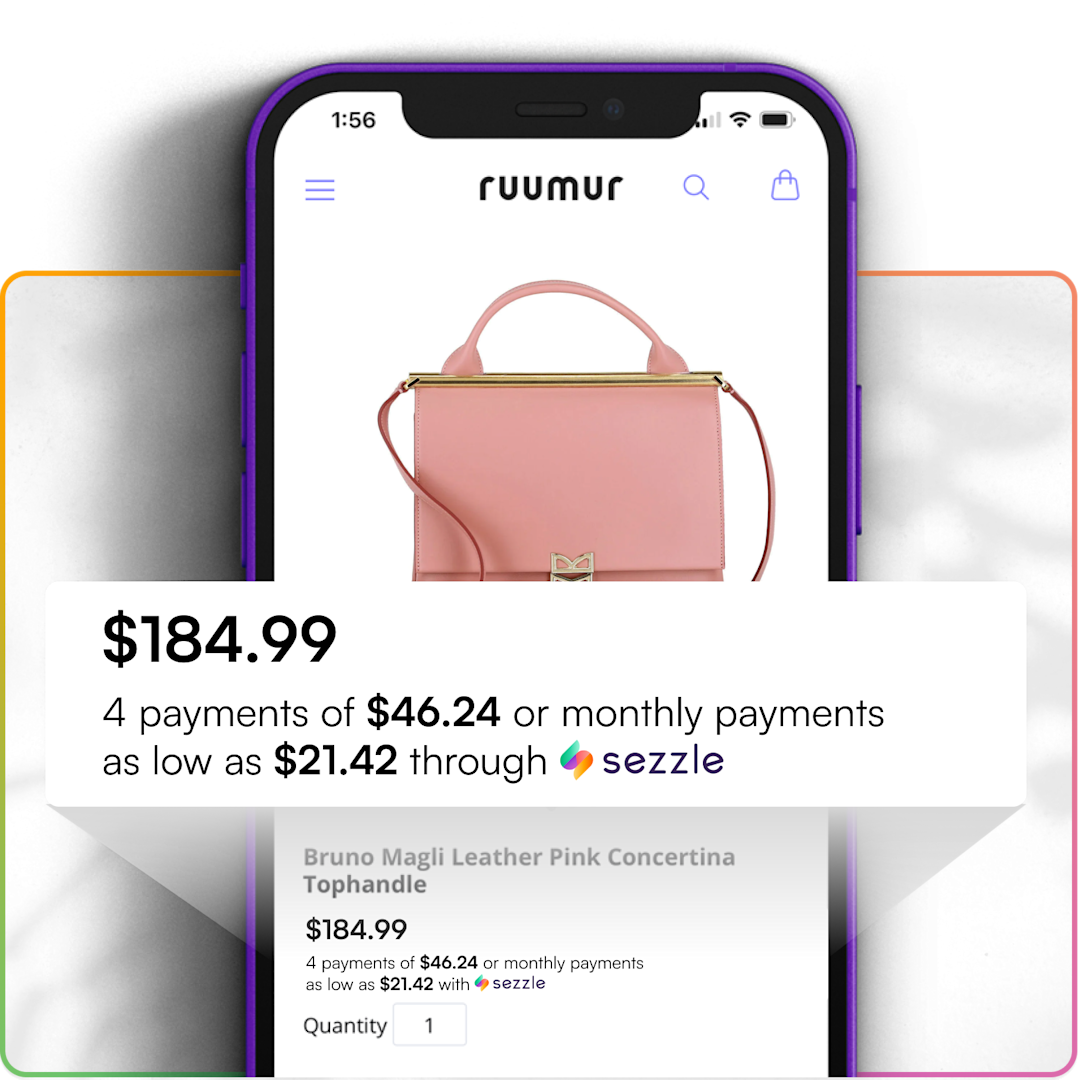

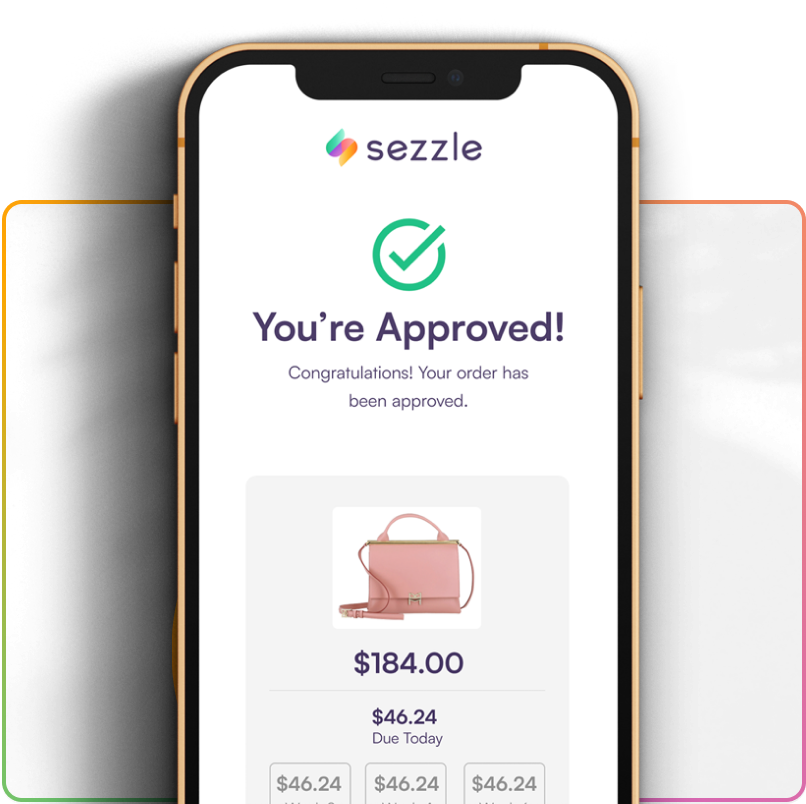

Buy Now Pay Later at Catalogs with Sezzle Split Payments No Interest

Buy Now Pay Later at Catalogs Split Payments No Interest

Millionaires Giving Money Buy Now Pay Later Catalogs Instant Credit Approval in 2020

Buy Now Pay Later Catalogs with Instant Approvals Medium

Buy Now Pay Later at Catalogs Split Payments No Interest

buy now pay later apps uk Concur Podcast Miniaturas

Merchandise Cards Catalog Credit Cards Instant approval credit cards, Credit card sleeve

Buy Now Pay Later Catalogs— Instant Approval No Money Down QueryChap

Millionaires Giving Money Use Buy Now Pay Later Catalogs If You Need Money Now 2014

Learn The Requirements, Fees, And Interest Rates For Each Catalog And How To Apply Online.

Find 11 Buy Now, Pay Later Shopping Options Inside, Including Their Payment Plans And Fees.

You Don’t Have To Worry About Your Credit Score And The First Payment Is Typically.

Compare Credit Levels, Deferred Payments, Down Payments, And Interest Rates For Each Catalog.

Related Post: